(PRESS RELEASE) LAS VEGAS — RAPAPORT: Diamond prices fell heavily in July as weak retail demand persisted. De Beers’ 5% to 15% reduction in many rough prices contributed to the decline, as did very strong competition from synthetics.

Rounds from 0.50 to 2.99 carats were extremely weak. Fancy shapes were better but also slow, with orders only for the nicest makes.

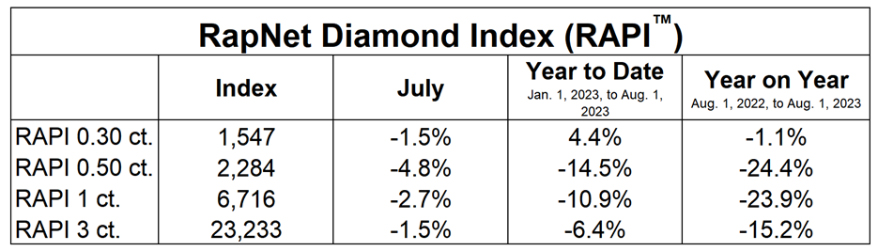

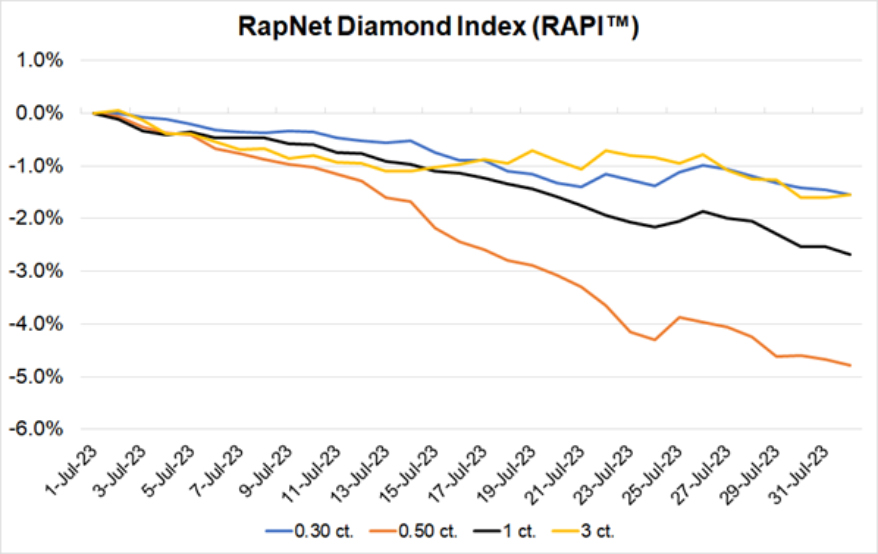

The RapNet Diamond Index (RAPI™) for 1-carat diamonds slid 2.7% for the month. It stood at 6,716 on August 1, down 10.9% since January 1. The RAPI also declined in other sizes, with 0.50-carat diamonds the weakest.

© Copyright 2023 by Rapaport USA Inc.

The drop was even steeper for diamonds with lower colors and clarities than those the RAPI tracks. The price index for 1-carat, D-L, IF-SI2 items fell 3.7% in July.

High inflation and interest rates continued to restrict middle America’s spending. The high-end segment supported the market as consumers with savings bought branded jewelry. China’s post-lockdown recovery did not extend to diamonds.

Advertisement

Manufacturers accumulated inventories of less-desirable stones. However, beautiful SIs were in demand and hard to find. The number of diamonds on RapNet was flat during the month and came to 1.75 million on August 1, reflecting lower production.

Dealers and manufacturers sought to reduce their inventory, but dealers were cautious about buying, fearing prices would fall further. The severity and frequency of the price drops created uncertainty about future price levels.

The lab-grown diamond sector continued to gain market share, especially in 1- to 3-carat, SI1 goods. Jewelers were attracted by the strong margins: Wholesale synthetics prices have plummeted, but retail prices remain high. A number of major polished manufacturers have also entered the synthetics space.

Rough purchases remained low due to weak polished demand and uncertain manufacturing margins. De Beers reduced prices of larger rough diamonds by 5% to 15% at its July sight and registered sales of $410 million — its lowest since December 2021.